How To Use The DCF Modeling Tool

Follow these easy steps

1

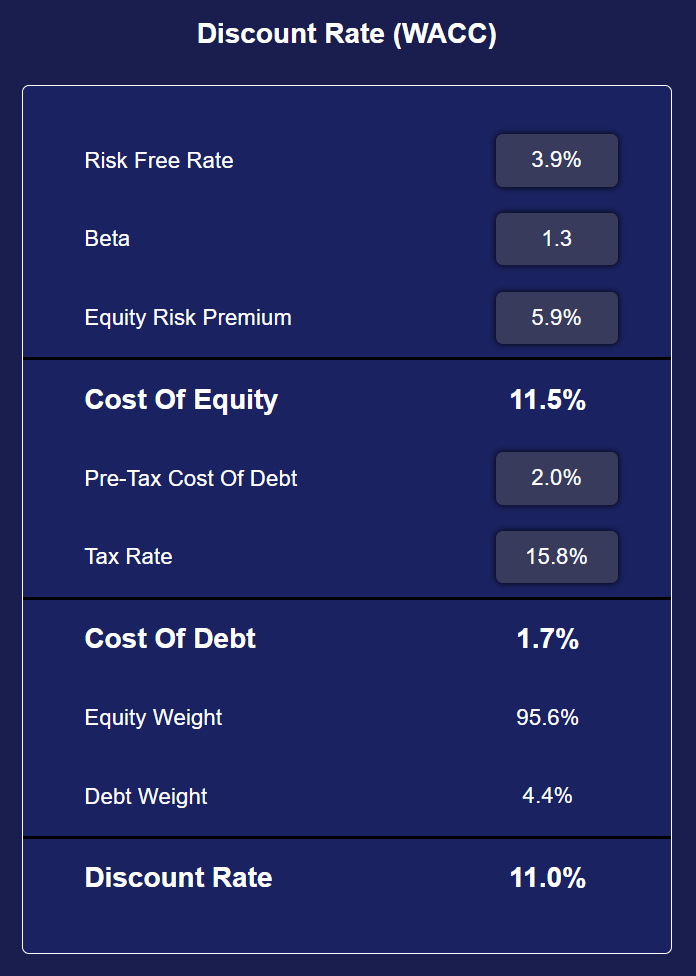

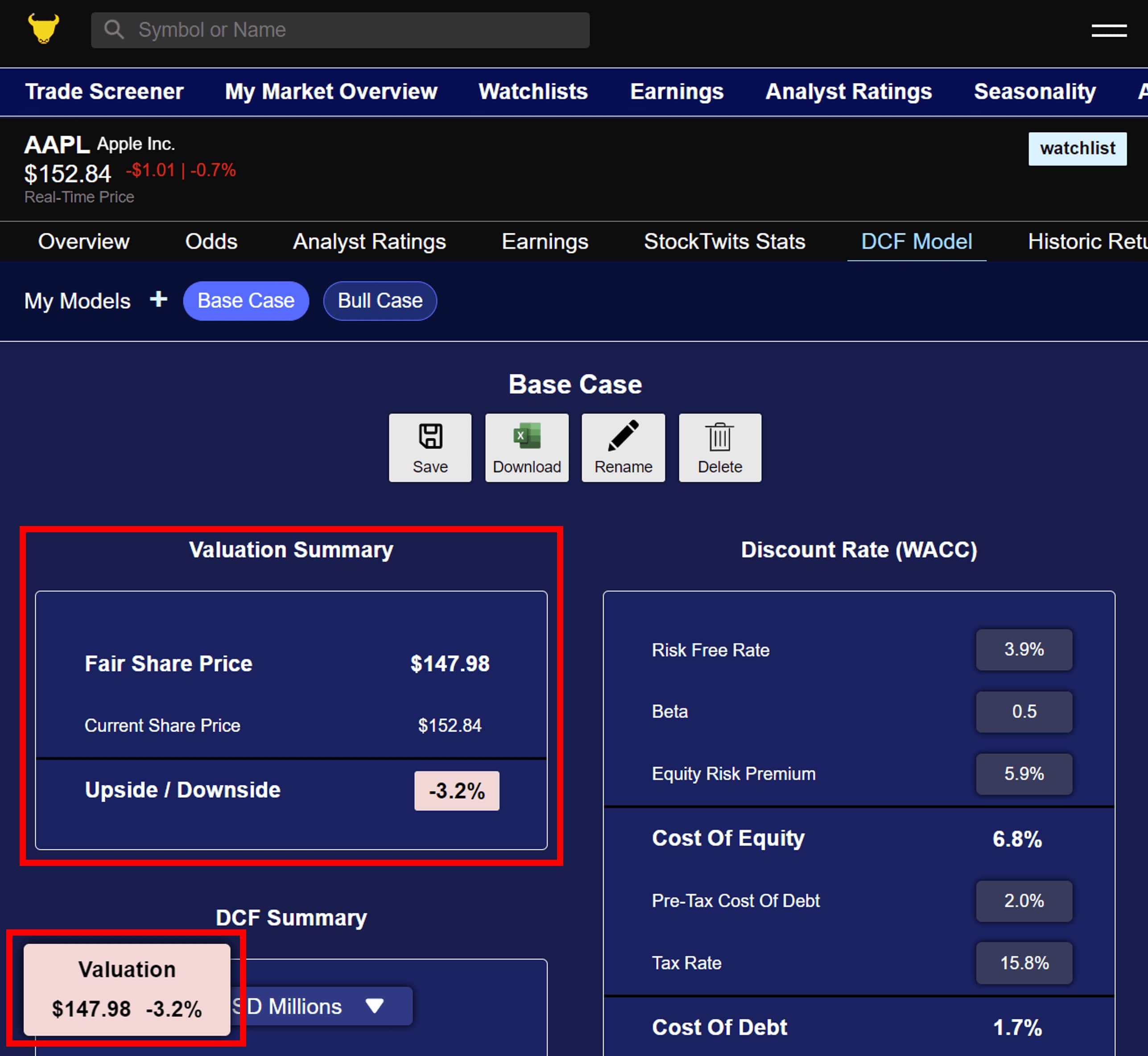

Set up the Discount Rate that will be applied to all future cashflows of the company

Traditionally WACC (Weighted Average Cost of Capital) is used as the discount rate. Our model provides a default set up for each company's WACC. The default setting calculates the cost of equity based on each stock's beta and current risk free rate. The cost of debt is estimated based on the interest and taxes the company paid during the most recently reported 12 months of financials. Finally, the equity and debt weights are calculated by using the company's market capitalization as the amount of equity and the debt on the company's balance sheet as the amount of debt. You can easily adjust the WACC by inputting your own assumptions.

Click here for a clear explanation of what WACC is

2

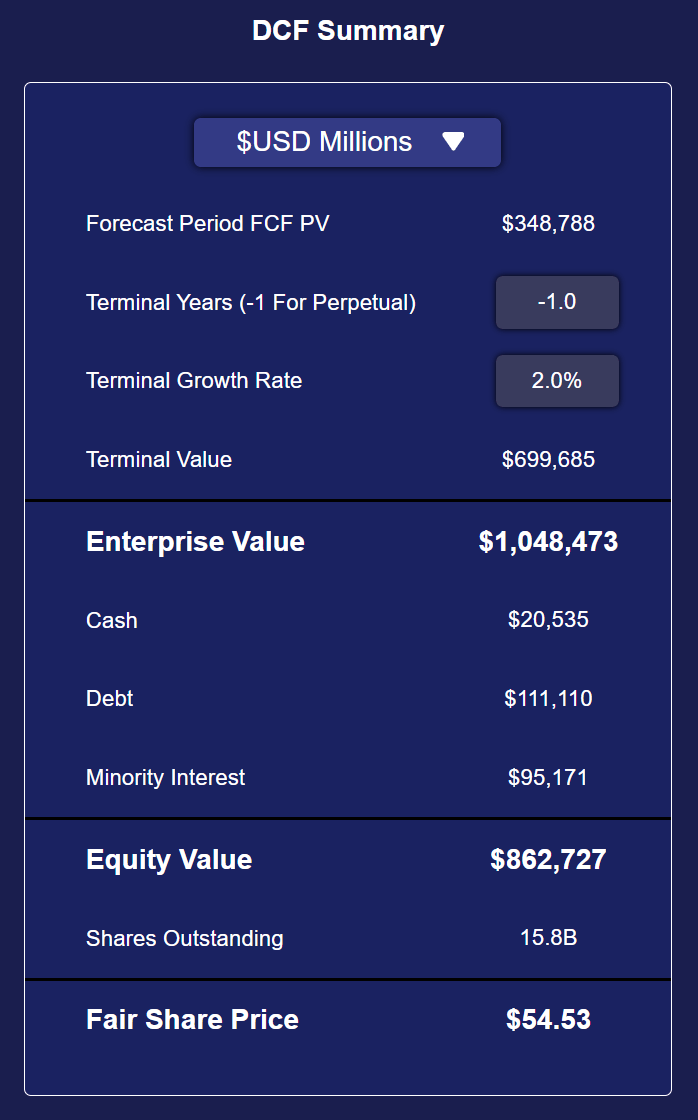

Set up the Terminal Growth Rate and Terminal Period Duration that will be used to calculate the Terminal Value

In most cases the terminal period duration is assumed to be infinite/perpetual, so our default setting here is -1 which represents a perpetual terminal period. However, you can change this to any number of years that you feel is appropriate.

For the Terminal Growth rate our default setting is typically 2%, this number is random and should be adjusted based on the ongoing growth rate you expect to see in the company's cashflows for the period following the years which are explicitly forecasted in the model.

Click here for a clear explanation of what Terminal Value is

3

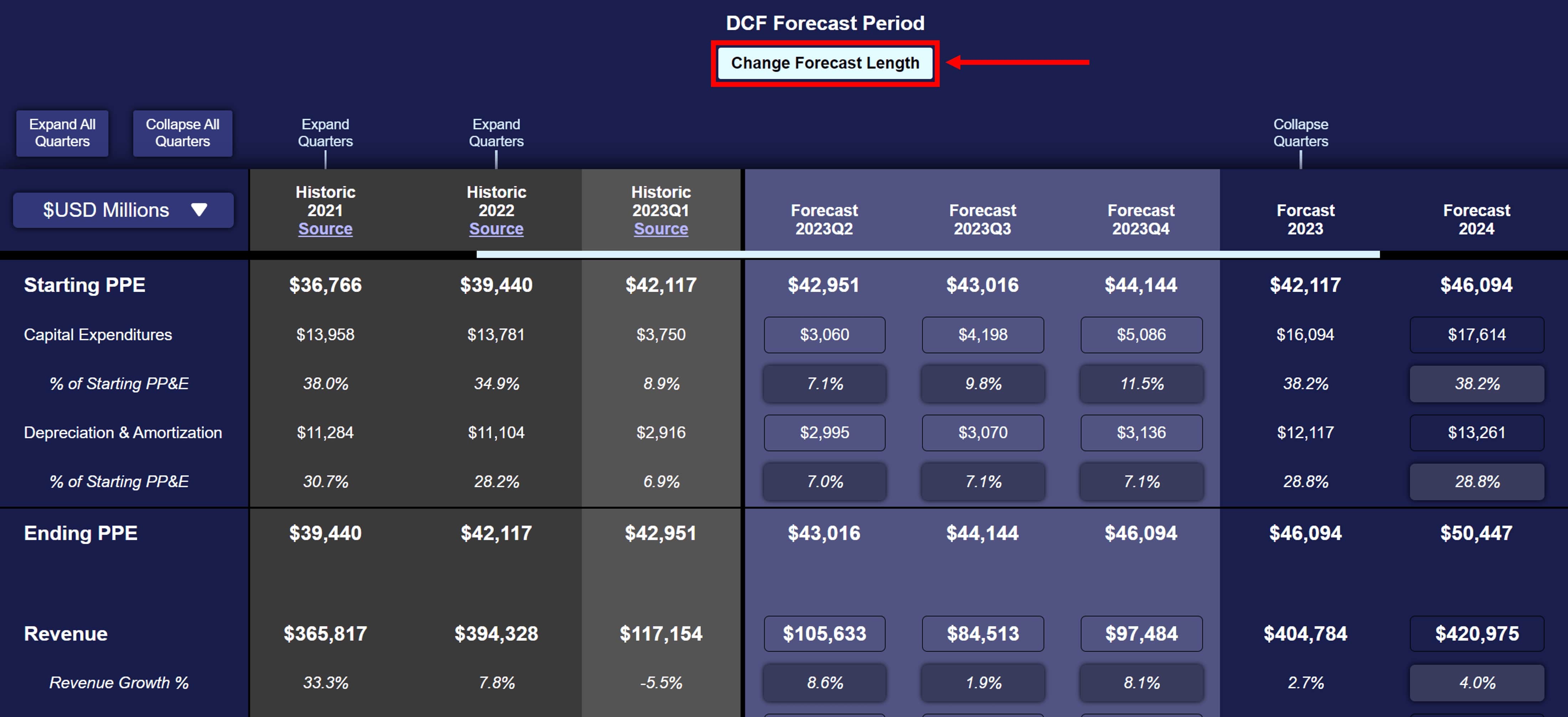

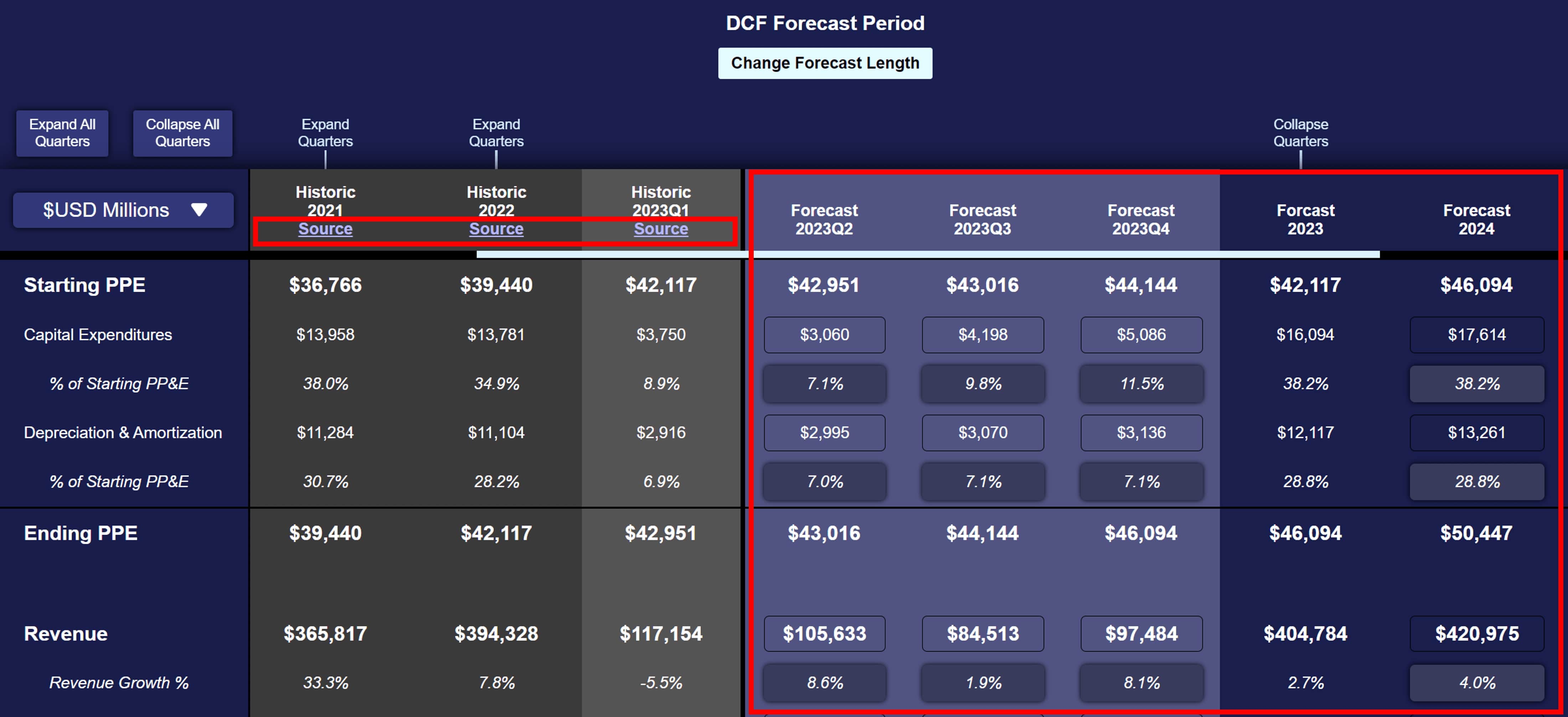

Select the number of future years you want to do a detailed forecast for

By clicking the "Change Forecast Length" button you can select how many future years you want to perform a detailed line item forecast for. Normally, the forecast period length should be between 5-10 years. Businesses change a lot over long periods of time so forecasting for more than 10 years might not be beneficial.

4

Forecast The Financial Line Items That Impact Future Cashflows

Our models let you forecast all of the line items from the balance sheet and income statement that impact the future cashflows of a company. The default forecast values for each line item are based on either the most recent historic quarters or the most recent historic year. You can change every line item in the forecast period to reflect your opinion of what you think will happen in the future. Our models include all of the historic values for any quarterly report that has already been released for the current fiscal year and every quarterly and annual report released in the prior 4 fiscal years. You can see the official source of every historic value by clicking the source button under any historic period. The point of the historic data is to provide you with a baseline for when you are forecasting a company's future line items.

This guide provides some techniques for forecasting income statement line items in the DCF

This guide provides some techniques for forecasting balance sheet line items in the DCF

5

See how your forecasts impact the intrinsic value of the company's stock

6

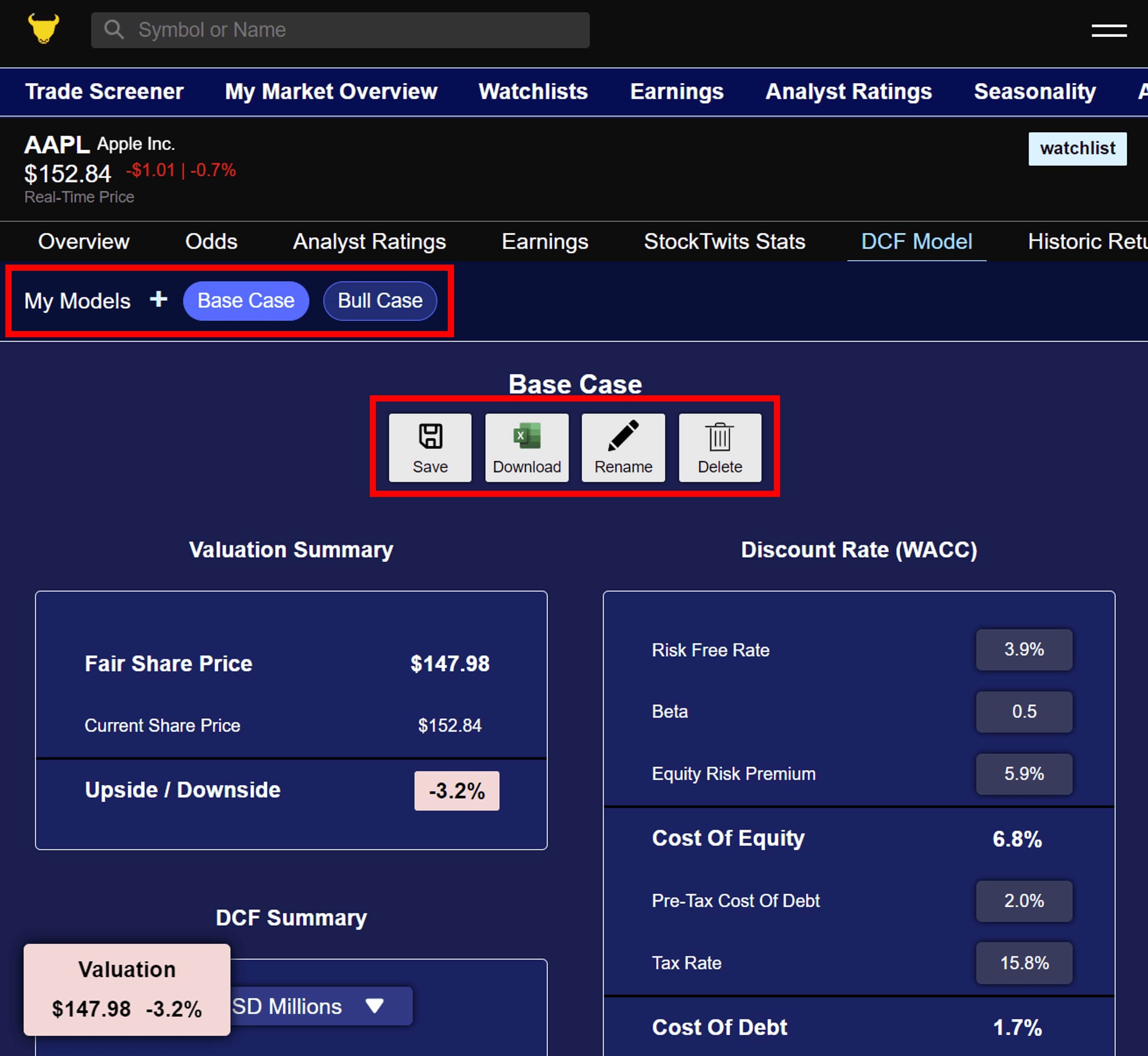

Save and download your model

7

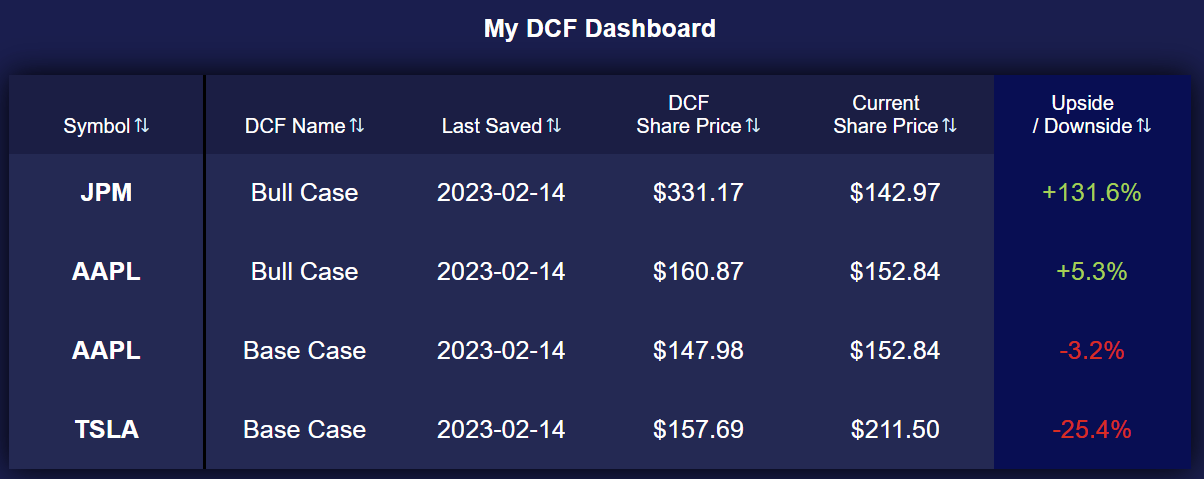

See how undervalued or overvalued the stocks that you've saved DCF Models for are

See summary statistics on all of your DCF models in your "DCF Dashboard" which you can find on the top right menu.